More Articles

Wallet based naira payments go cross border

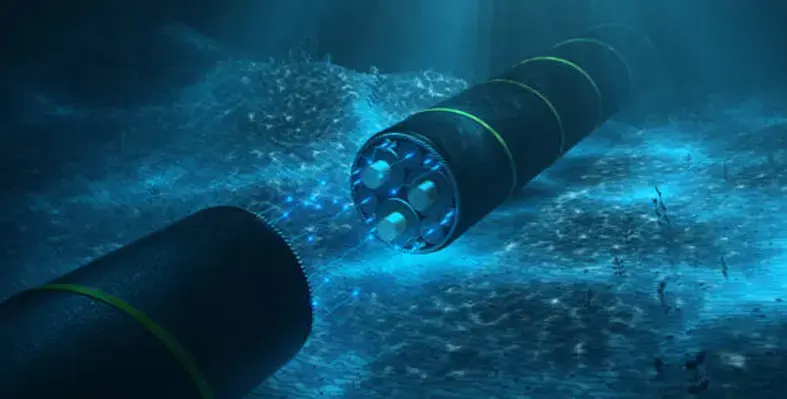

Global leaders reaffirm commitment to submarine cable resilience

Partnership strengthens digital access for timbuktoo University Innovation Pods in Sierra Leone and The Gambia. (Image source: UNDP)

UNDP, Africell expand digital access for young innovators

Airtel Africa posts strong nine-month growth

Vertiv introduces Next Predict, an AI-driven managed service enabling predictive maintenance across power, cooling, and IT systems. (Image source: Vertiv)

Vertiv launches AI-powered predictive data centre service

Cassava and AXON leverage AI and fibre networks to deliver Africa’s first real-time, scalable Operator-as-a-Service. (Image source: Cassava Technolgies)

Cassava and AXON launch Africa’s OaaS platform

David Bunei country leader Kenya Oracle and Snehar Shah CEO iXAfrica Data Centres. (Image source: iX Africa)

iXAfrica to host oracle cloud region in Kenya

Starlink’s South Africa entry sparks debate

African telecoms and financial companies join global leaders on WorkL’s 2026 World’s Happiest Workplaces list.