The African telecommunications market has called for a new multi-faceted approach to test equipment sourcing, writes Basel Shubair

With many African economies now seeing high levels of growth, the need for greater communications coverage and more sophisticated infrastructure capable of supporting higher data capacities is starting to take hold across the continent.

UMTS-based 3G networks are in the process of being launched in a many of its countries as consumer demand for mobile handsets supporting the multimedia, location and financial services that are now commonplace in the Western world begins to rise.

Until now, the mobile market in Africa has been dwarfed by those of more developed regions, with only 53 per cent penetration compared to 119.5 per cent for Europe, according to ITU figures compiled for last year. This is, however, rapidly changing.

Industry analysts at Informa have predicted there will be more than one billion mobile subscribers situated within the African continent by 2016, almost doubling the total number in 2011.

By this time Nigeria will have approximately 140mn subscribers - with Egypt at 130mn, South Africa at 70mn, Morocco at 45mn, Algeria at 40mn and Kenya at 35mn remaining the six largest subscriber bases for the foreseeable future.

As more advanced networks begin to be rolled out, the problem of how to go about sourcing the various items of equipment needed for implementing, monitoring and troubleshooting new base stations must be faced.

The purchasing price of such hardware could prove difficult for organisations located within many African states to cope with. Furthermore, once the initial testing activity has been carried out, there may be very little residual need for this equipment in anything other than low numbers of units.

Of prime importance to any company within the telecom sector, where ever they are in the world, is keeping the financial risks involved to a minimum. The nature of this business makes it very hard to calculate exactly what will happen in the short/medium term, let alone further into the future. This inherent unpredictability is particularly acute in African nations where the telecom industry has still to fully mature.

African mobile operators and their contractors need access to advanced instrumentation with which they can upgrade legacy networks and bring coverage to areas not previously served. The way in which they go about achieving such goals, without being left financially vulnerable, needs very serious consideration. In many cases they are looking to explore alternative sourcing solutions.

Renting equipment

Test equipment rental has already proved its worth in countries like the USA (constituting around 20 per cent of the total market there), the UK, France and India. The nature of the African telecommunications landscape, where a far more pronounced need to avoid large capital investment exists, is likely to make it a popular option here in the coming years.

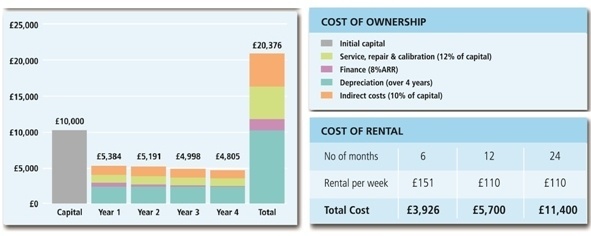

The rationale behind organisations renting test hardware as opposed to taking the more conventional route of direct purchase is being regarded as particularly valid in developing countries, such as those found in many parts of Africa. It allows these organisations to add the desired pieces of equipment to their operations without warranting a heavy initial outlay of funds. They are not exposed to on-going running costs (insurance, maintenance, repair, recalibration, finance repayment, downtime cover and transportation), which often effectively double the cost of ownership of a piece of equipment over a period of 3 years (see Figure 1 below).

Rental also resolves issues of availability, so that additional equipment can quickly be sourced in order to satisfy sudden surges in demand, whereas purchasing can have long lead times to contend with. It permits much greater flexibility too, so that changes in test requirements don’t call for additional expense later on. Immediate fault replacement means that the impact of downtime can be circumvented.

Rental also resolves issues of availability, so that additional equipment can quickly be sourced in order to satisfy sudden surges in demand, whereas purchasing can have long lead times to contend with. It permits much greater flexibility too, so that changes in test requirements don’t call for additional expense later on. Immediate fault replacement means that the impact of downtime can be circumvented.

Furthermore, as utilisation and payment are effectively synchronised together, it is much easier to ensure full return on the investment. Equipment can be returned as soon as it is no longer needed. Finally, employing a rental strategy means that cash is not tied up in inventory, but can be used elsewhere – thereby allowing African mobile operators/contractors to be more fiscally agile.

Buying used equipment

The option of procuring used rather than new test tools also has an important role to play in the still nascent African market, where making the necessary funds available for acquisition of costly brand new models may be particularly hard to justify. This once again can have major risks associated with it however.

Often used equipment suppliers, as they brought the items elsewhere, don’t have good records about how long the test hardware they are selling has been in use, its treatment over that time, or how regularly it was subject to maintenance/recalibration.

As a result it is difficult to make a good appraisal of the overall condition of that equipment prior to purchase. This is compounded by the fact that, as most used equipment suppliers are relatively small, they have only limited stock – potentially resulting in customers compromising on which manufacturer’s products they take and thus not being able to execute their test activities as effectively as they wanted.

Post-sales technical support is unlikely to feature as part of the package when dealing with conventional used equipment suppliers, once again adding to the inconvenience experienced by the customer.

The prospect of buying ‘nearly new’ ex-rental equipment, in contrast to dealing with typical used equipment brokers, is likely to be more favourable, instilling a greater degree of confidence. This has several key advantages:

1 – The rental firm will have full details of each item’s working history, plus maintenance/calibration records.

2 – Post-sales technical/application support can be provided.

3 – Warranties can be offered for equipment - ensuring the customer is not in danger of having to pay for costly repair work.

Western rental firms who have managed to establish themselves in the African market are uniquely positioned. They can offer organisations there the 3G test equipment now needed from stock they carry in other parts of the world, such as Europe (where it has now been superseded by 4G equipment and is less likely to be used). This effectively extends the service life of equipment - allowing it to be sold at highly competitive prices, having already generated considerable revenue through its rental duties.

In conclusion, the rental of equipment or purchase of high quality used equipment present the African telecom industry with totally different fully vendor agnostic approaches to those traditional followed. They make the responsibility for investing in equipment inventory that of the chosen sourcing partner – who is far better placed to do so. This permits the financial barriers normally preventing the sourcing suitable items of equipment to be overcome, while simultaneously protecting the company sourcing it against the procurement dangers already outlined.

Basel Shubair, Livingston