SES S.A. and Intelsat S.A. have entered into an agreement for SES to acquire Intelsat by purchasing 100% of the equity of Intelsat Holdings S.a.r.l. for a cash consideration of US$3.1bn (€2.8 billion) and certain contingent value rights

This acquisition aims to create a stronger multi-orbit operator, providing improved coverage, resiliency, and an expanded suite of solutions in the satellite communications industry.

The combined entity will offer greater value for customers and partners, presenting a competitive alternative in the evolving market landscape. The transaction is expected to receive regulatory approvals and filings during the second half of 2025. It has been unanimously approved by the boards of both companies and is supported by Intelsat shareholders holding approximately 73% of the common shares.

Key highlights of the transaction include:

* Anticipated synergies of €2.4 billion (NPV), representing 85% of the equity consideration, with 70% expected to be realised within three years post-closing.

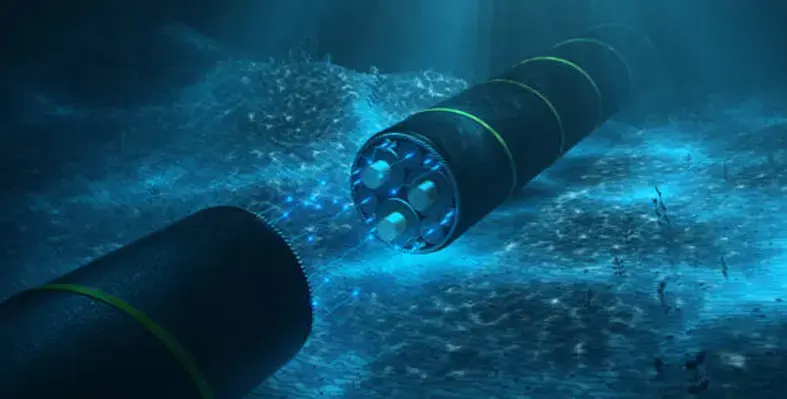

* Expansion of multi-orbit satellite capabilities, spectrum portfolio, and global ground network to better serve customers.

* Increased revenue in high-demand Networks segments, comprising approximately 60% of the expanded revenue base.

* Combined investment in space, ground, and network innovation to unlock future opportunities.

* Utilisation of collective talent, expertise, and track record to drive growth and profitability.

Adel Al-Saleh, CEO of SES, commented, “This important, transformational agreement strengthens our business, enhances our ability to deliver world-class customer solutions, and generates significant value for our shareholders in a value accretive acquisition which is underpinned by sizeable and readily executable synergies.

SES, Intelsat merger: Growth strategy

In a fast-moving and competitive satellite communication industry, this transaction expands our multi-orbit space network, spectrum portfolio, ground infrastructure around the world, go-to-market capabilities, managed service solutions, and financial profile. I am excited by the opportunity to bring together our two companies and augment SES’s own knowledge base with the added experience, expertise, and customer focus of the Intelsat colleagues.

Going forward, customers will benefit from a more competitive portfolio of solutions with end-to-end offerings in valuable Government and Mobility segments, combined with value-added, efficient, and reliable offerings for Fixed Data and Media customers. This combination is also positive for our supply chain partners and the industry in creating new opportunities as satellite-based solutions become an increasingly integral part of the wider communications ecosystem.

Our expanded business will deliver sustained EBITDA growth and strong cash generation, in turn supporting incremental profitable investment in capabilities and solutions to fulfil rapidly expanding and evolving customer demand while also delivering sustained returns to shareholders.”

David Wajsgras, CEO of Intelsat, commented, “Over the past two years, the Intelsat team has executed a remarkable strategic reset. We have reversed a ten year negative trend to return to growth, established a new and game-changing technology roadmap, and focused on productivity and execution to deliver competitive capabilities. The team today is providing our customers with network performance at five 9s and is more dedicated than ever to customer engagement and delivering on our commitments. This strategic pivot sets the foundation for Intelsat’s next chapter."

The transaction will be financed through existing cash reserves, new debt, including hybrid bonds, and contingent value rights related to potential future monetisation of spectrum usage. Both companies will continue to focus on executing their near-term objectives until the transaction closes.

The combined entity will remain headquartered in Luxembourg, with a significant presence in the U.S. The acquisition is expected to be free cash flow accretive from year 1 and will leverage the companies' combined contract backlog, growth-oriented portfolios, and strong balance sheet metrics.

Integration of the two companies will enable the realisation of synergies primarily through operational efficiencies and optimisation of satellite fleets and ground infrastructure. The combined fleet of over 100 GEO and 26 MEO satellites will provide enhanced coverage, resiliency, and service delivery capabilities.

The transaction is expected to strengthen the competitive positioning of the combined company, particularly in Government, Mobility, Fixed Data, and Media segments. Customers will benefit from an expanded set of solutions, improved network reach, and enhanced reliability.

Based on the financial outlook, the combined company anticipates annual revenue of €3.8 billion, with low- to mid-single-digit average annual growth over the medium term. The transaction is expected to deliver an internal rate of return of over 10% and maintain investment-grade balance sheet metrics.

Guggenheim Securities, Morgan Stanley & Co. LLC, and Deutsche Bank Securities Inc. acted as financial advisors, providing committed financing for the transaction. Legal counsel was provided by Gibson, Dunn & Crutcher, Arendt & Medernach, Hogan Lovells, and Freshfields.