PalmPay, a leading digital finance and neobank platform serving emerging markets, has been named the fastest-growing financial services company in the Financial Times’ Fastest-Growing Companies in Africa 2025 list

Compiled in partnership with Statista, the list placed PalmPay at #2 overall out of 130 ranked companies.

The annual list highlights Africa-based firms that demonstrate strong performance across key metrics such as revenue growth, user base expansion, and operational scale. Between 2020 and 2023, PalmPay posted a compound annual growth rate (CAGR) of 583.6%, driven by its rapidly scaling suite of technology-driven financial services in Nigeria.

As of 2025, the platform has surpassed 35 million registered users, processing up to 15 million transactions daily, solidifying its role in driving the continent’s digital financial evolution.

“The Financial Times’ recognition of PalmPay as Africa’s fastest-growing fintech is a powerful validation of our approach to closing financial access gaps in underserved markets,” said Sofia Zab, founding chief marketing officer at PalmPay. “We’ve combined cutting-edge technology with localised innovation and distribution to build a leading neobank used by tens of millions to access payments, credit, savings, insurance and more. As we expand our ecosystem and enter more markets, we’re excited to continue supporting our users to achieve their financial goals, while accelerating growth for our partners.”

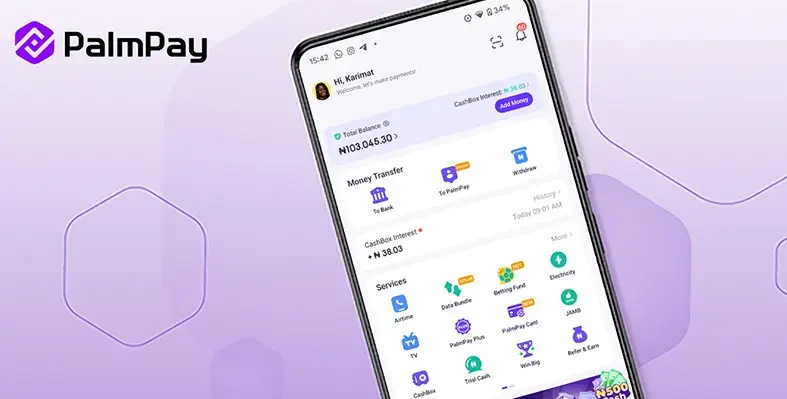

PalmPay’s model blends a user-centric digital financial superapp with a robust offline infrastructure of over one million merchants and agents, ensuring wide-reaching access even in traditionally underbanked regions. Its diverse offerings span money transfers, credit, merchant payments, savings, investment tools, insurance, and business services for MSMEs. It also supports B2B payment flows, easing collections and disbursements for African and global merchants serving the continent.

“Our growth is propelled by a clear vision: to empower businesses and individuals with frictionless, reliable financial tools,” remarked Jiapei Yan, group chief commercial officer at PalmPay. “We’re deepening partnerships across the fintech ecosystem to enhance payment infrastructure and foster a more connected African economy. As we scale, we remain focused on accessibility, innovation, and regional collaboration to drive the growth of digital economies in emerging markets.”

Since launching in 2019, PalmPay has played a transformative role in boosting financial inclusion and supporting the adoption of digital, cashless payments. On average, its customers perform over 50 transactions per month, engaging with both everyday payments and more long-term financial products, such as savings and insurance services. Notably, 25% of PalmPay’s users opened their first-ever financial account on the platform, marking its strong performance in integrating previously excluded communities into the formal financial system while maintaining frequent user engagement.