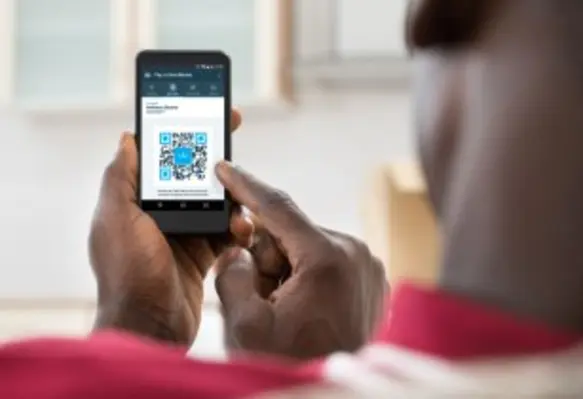

Youtap has launched a QR code solution and smartphone apps for mobile money services in Africa and Asia

Mobile

Google to launch affordable smartphone in Nigeria in September 2017

Google has announced to launch the affordable ICE 2, an android-supported mobile smartphone, for Nigeria in September 2017, at the price of US$40

IPO set for 15 August 2017, for Vodacom Tanzania

Vodacom Tanzania has completed significant milestones by selling around 560mn shares ahead of its initial public offering (IPO) on the Dar es Salaam Stock Exchange which is expected to take place 15 August 2017

Kenyan girls travel to Google HQ after creating app to end FGM

Five Kenyan girls have designed an app which aims to end the fight against Female Genital Mutiliation (FGM)

Tigo Tanzania announces an upgrade and expansion of its services

Tigo Tanzania has announced a huge drive to continue its modernisation programme of its network infrastructure